Workers from 36 ports across the Eastern U.S. walk out over contract disputes, raising concerns over potential supply chain disruptions and price increases if the strike extends.

For the first time in decades, dockworkers from 36 ports across the Eastern United States are on strike, raising potential concerns over supply chains, possible shortages, and higher consumer prices if the situation persists beyond a few weeks.

The walkout, which began early Tuesday, follows a dispute over wages and the increased use of automation at the ports. The International Longshoremen’s Association (ILA), representing approximately 45,000 workers, let their contract expire at midnight, initiating the strike after contract negotiations failed to reach a resolution.

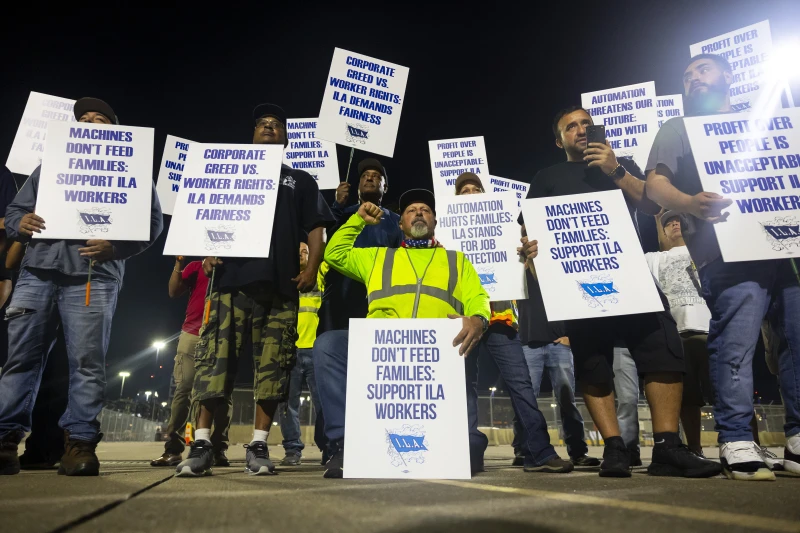

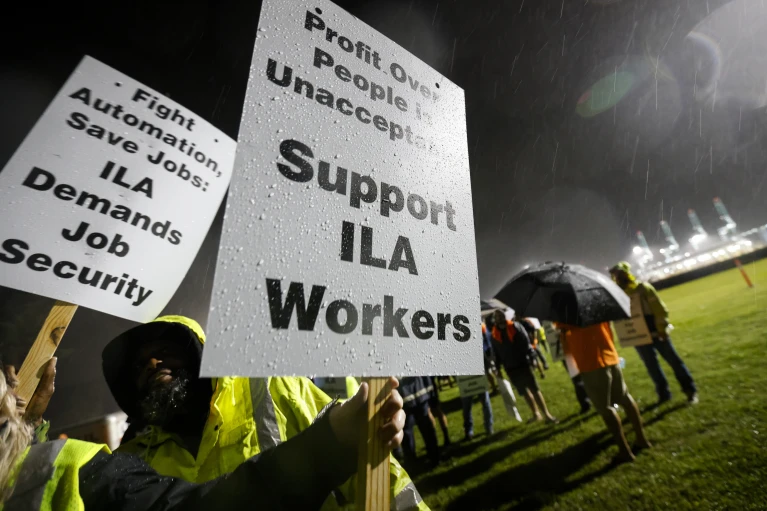

Picket lines formed in various ports, including the Port of Philadelphia, where union members protested, chanting demands for a fair contract. A message posted on a truck nearby declared, “Automation Hurts Families: ILA Stands For Job Protection.”

This strike marks the first major labor action for the ILA since 1977, highlighting workers’ deep concerns over the potential impact of automation on their jobs. The movement comes at a politically sensitive time, just weeks ahead of a tight presidential election, and could have significant implications for voters if supply chain disruptions affect the availability of goods.

Boise Butler, president of the union local, emphasized the workers’ determination to secure a fair contract without compromising their jobs to automation. As Butler stated, “We want them to pay back. They’re going to pay back.” He underscored that the union is prepared to continue the strike for as long as necessary to secure favorable terms, noting that the workers play a vital role in the nation’s economy and possess significant bargaining power. “This is not something that you start and you stop,” Butler remarked. “We’re not weak.”

Meanwhile, at Port Houston, at least 50 dockworkers began picketing around midnight local time, carrying signs demanding a fair contract. The U.S. Maritime Alliance, which represents the ports, indicated on Monday night that while both sides had revised their initial wage offers, they had yet to reach an agreement.

Labor experts believe that the ILA holds substantial leverage during these negotiations. The previous contract was established before the COVID-19 pandemic, and since then, factors such as inflation and concerns over advancing technology have bolstered the union’s standing.

William Brucher, an assistant professor of labor studies at Rutgers University, noted that while inflation has decreased, the cost of living remains higher than pre-pandemic levels, reducing the purchasing power of workers’ wages. This timing is particularly advantageous for the union to push for more favorable terms. Furthermore, Brucher pointed to a broader trend in labor activity, where unions across industries have increasingly demanded better pay and conditions, often resulting in company concessions.

In the lead-up to the strike, the union’s initial proposal sought a 77% wage increase over the contract’s six-year duration, with ILA President Harold Daggett citing the need to offset inflation and previous modest raises. While the base salary for ILA members is about $81,000 annually, some workers can earn upwards of $200,000 with substantial overtime.

The Maritime Alliance responded with an offer of a 50% raise over six years, alongside a commitment to retain the existing limitations on automation from the previous contract. Additionally, the alliance pledged to triple employer contributions to retirement plans and improve healthcare options. However, the union remains firm on its demand for a complete ban on automation, rejecting the alliance’s offer as insufficient.

Supply chain experts predict that the strike will not have an immediate impact on consumers, as most retailers have preemptively stocked up on goods, including holiday items. However, if the strike extends beyond a few weeks, there could be significant repercussions, such as delayed shipments and increased prices on various products.

This disruption could particularly affect perishable goods like bananas, which are largely handled by the affected ports and make up about 75% of the nation’s supply, according to the American Farm Bureau Federation. Additionally, the strike could impede exports from East Coast ports and lead to congestion at West Coast ports, where a different union represents workers.

According to a report by the Associated Press, J.P. Morgan has estimated that a prolonged shutdown of ports along the East and Gulf Coasts could cost the U.S. economy between $3.8 billion and $4.5 billion per day, with some of those losses potentially recovered once normal operations resume. Several industries, including retail, automotive, and produce importers, had hoped for either a settlement or federal intervention to prevent a prolonged work stoppage.

Despite these economic concerns, President Joe Biden has indicated no intention to intervene, saying “no” when asked if he planned to use the Taft-Hartley Act to enforce an 80-day cooling-off period. The White House, however, assured that administration officials are working “around the clock” to assist negotiations, with both Biden and Vice President Kamala Harris closely monitoring potential supply chain issues.

A task force has been established to address and prepare for any disruptions. The president’s stance on non-intervention is seen as a strategic move to maintain support from labor unions, which are considered essential to Democratic turnout in the upcoming election. Brucher noted that the use of a Taft-Hartley injunction is “widely despised” by unions and could alienate organized labor, crucial for both Biden and Harris’s political campaigns.