Improved climate conditions and growing international demand contribute to the expected production increase.

Peru’s mandarin and tangerine production is forecast to experience a notable increase in the marketing year (MY) 2023/2024, with production expected to reach 560,000 metric tons (MT), according to a report by Miluska Camacho, prepared for the U.S. Department of Agriculture’s Foreign Agricultural Service and approved by Zeke Bryant.

This represents a two percent rise from the previous year, driven by cooler weather and favorable conditions that are anticipated to positively impact both production and exports.

The Peruvian government and industry stakeholders are optimistic about the recovery and growth in this sector, projecting a three percent increase in exports, reaching 210,000 MT.

The cooler climate conditions observed as of late March 2024 have set the stage for a beneficial winter season for mandarin and tangerine crops, particularly for late varieties. These conditions are crucial for achieving the color standard required for exports, as mandarins need cool weather during their later stages of growth.

Early varieties, however, have faced challenges due to erratic weather and increased pest presence, attributed to the unusually warm summer temperatures from December 2023 to March 2024.

Despite these obstacles, the domestic market has shown good acceptance and pricing for early fruit varieties, providing stability for producers.

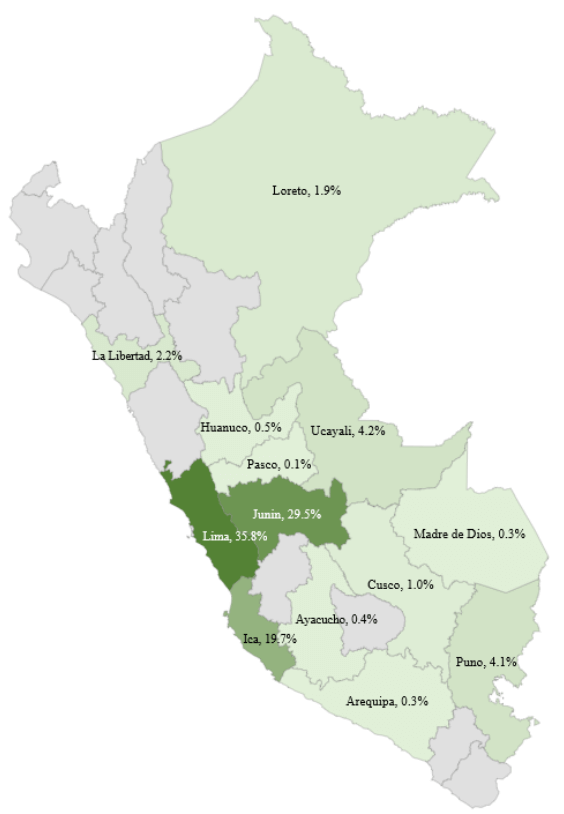

Peru’s mandarin production spans 13 of the country’s 25 regions, with coastal areas accounting for 60 percent of total production.

The primary producing regions include Lima, Junin, and Ica, which benefit from semi-tropical weather and good water availability.

These regions contribute significantly to the export-oriented production, taking advantage of the reduced pest pressure and large diurnal temperature variations.

The mandarin and tangerine varieties grown in Peru include Satsumas, Clementines, and various hybrids such as Tango, Orri, and Murcott.

These varieties are known for their easy peeling and seedless characteristics, making them highly desirable in international markets. The industry has seen a shift towards new royalty varieties aimed at the export market, with a one percent annual rate of replacing old varieties.

This trend reflects the industry’s commitment to keeping up with global market demands and enhancing profitability.

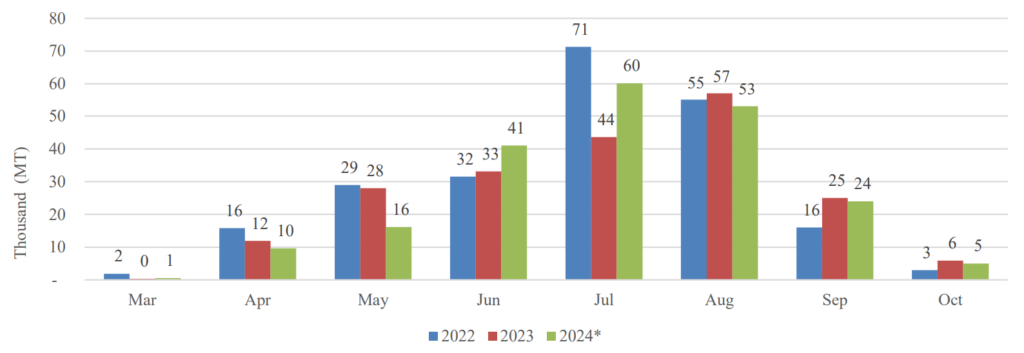

The production forecast for MY 2023/2024 indicates a stable harvested area of 23,000 hectares, consistent with the previous year. The harvest season in Peru runs from March to October, with a peak period from June to August.

Despite the challenges faced in the early part of the season, the overall production outlook remains positive, with late varieties expected to perform well due to the cooler and drier weather forecasted for the coming months.

Domestic consumption of fresh mandarins and tangerines is also on the rise, with a forecast of 322,000 MT in MY 2023/2024, marking a three percent increase from the previous year. Mandarins are a popular fruit in Peru, commonly included in lunchboxes and consumed as snacks.

The growing popularity of mandarin-based products such as juices, jams, and essential oils has further boosted domestic consumption. The per capita consumption of mandarins in Peru is estimated at 11 kilograms.

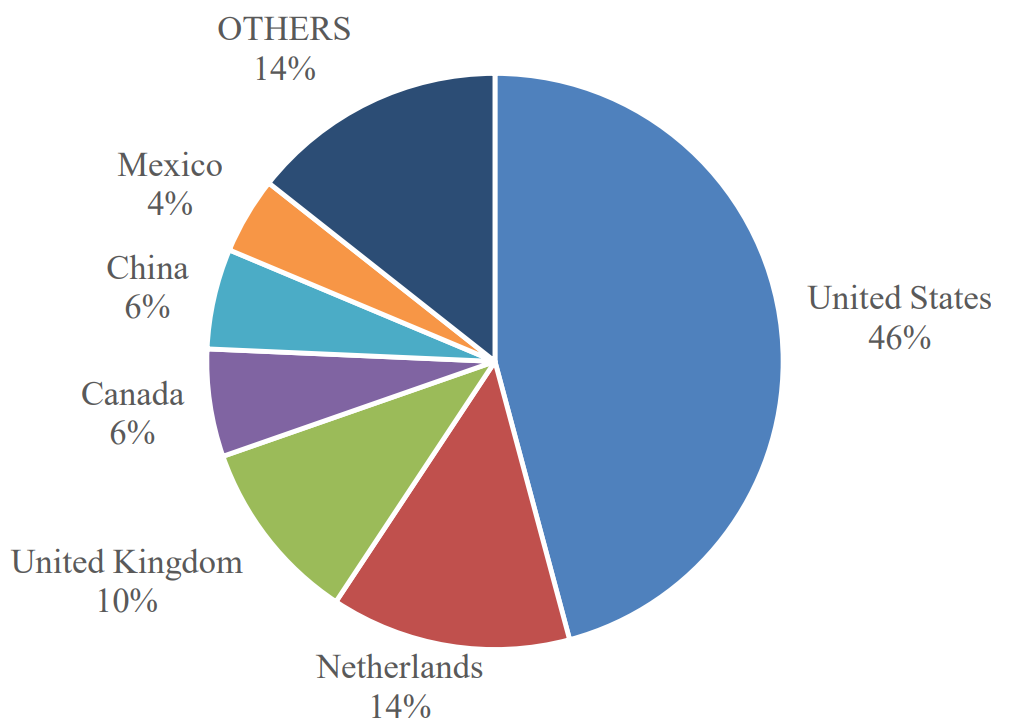

Peruvian mandarin exports are projected to recover in MY 2023/2024, with an expected increase to 210,000 MT.

The United States remains the top export partner, accounting for about 50 percent of exports, followed by the Netherlands and the United Kingdom.

Despite a decline in exports to the US in the previous marketing year, the current outlook is optimistic due to the improved performance of late varieties and favorable market conditions.

The Peruvian government has been instrumental in supporting the citrus industry’s growth through various initiatives and trade agreements.

The Peru Trade Promotion Agreement (PTPA) with the United States, which came into force in 2009, provides tariff-free access for Peruvian mandarins to the US market.

Additionally, the construction of the Megaport of Chancay, slated to be operational by the end of 2024, is expected to significantly enhance logistics and reduce shipping times to Asia, further boosting export potential.

The government’s efforts to integrate small farmers into the export chain and promote mandarin processing as an alternative to fresh produce have been crucial in driving industry growth.

The Peruvian citrus trade association, ProCitrus, representing 80 percent of the total citrus export industry, plays a vital role in coordinating research, development, and public-private partnerships.

Despite facing several abiotic challenges such as temperature shifts, humidity changes, and pest infestations, the Peruvian mandarin and tangerine industry remains resilient and poised for growth.

The industry’s strategic focus on new varieties, advanced farming techniques, and strong export promotion efforts underscore its commitment to maintaining Peru’s position as a leading producer and exporter of mandarins and tangerines.