Intensifying competition for eGrocery customers has turbo-charged demand as both total and Delivery monthly sales set record highs.

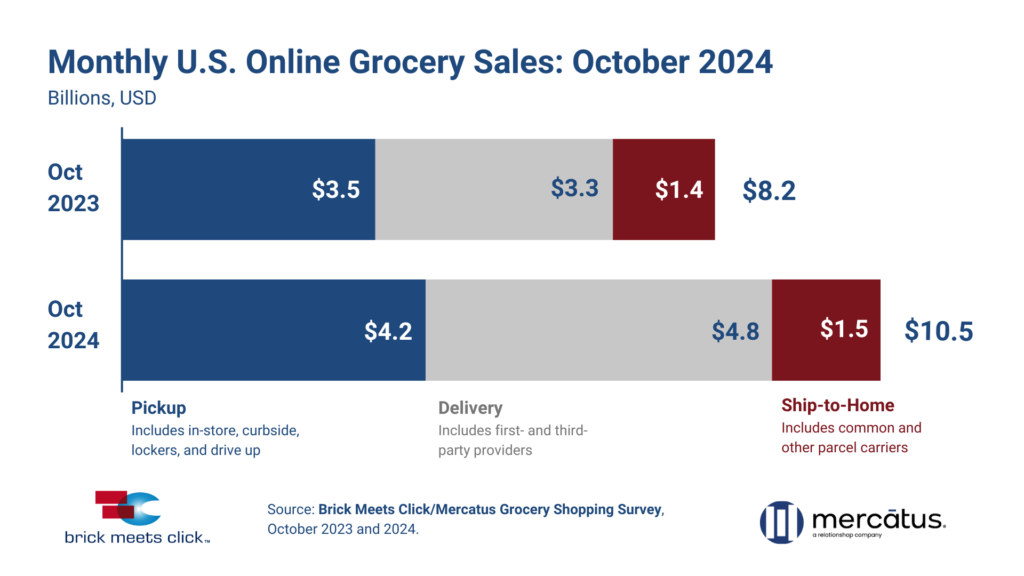

In October 2024, the U.S. online grocery market saw a significant surge, reaching a record-breaking $10.5 billion in monthly sales, marking a 27.9% year-over-year (YOY) growth.

This boost was recorded across all three main purchasing methods: Delivery, Pickup, and Ship-to-Home, according to the Brick Meets Click/Mercatus Grocery Shopper Survey conducted October 30-31, 2024.

This growth, which surpassed 20% for the second consecutive month, was driven in large part by promotional activities, particularly for Delivery services, that increased monthly active users (MAUs) and order frequency.

Delivery services, in particular, achieved an impressive 46% YOY growth, setting a new record at $4.8 billion. As noted in the report, the MAU base for Delivery services grew by 16% over the past year, with most of the increase attributed to customers between 30 and 60 years old.

This expanded user base, combined with a 24% increase in order volume, helped widen Delivery’s order share lead over Pickup in major metropolitan areas, representing approximately 60% of U.S. households. Additionally, Delivery’s average order value (AOV) rose by more than 15%, as frequent users tended to spend more.

Pickup services also showed strong performance, reaching $4.2 billion in October, a nearly 20% YOY increase despite limited promotional support. Pickup orders increased by 6%, driven mainly by higher order frequency rather than new customer acquisition.

The MAU base for Pickup expanded by less than 1%, with growth among younger and older age groups offsetting declines in the 45-60 demographic. Pickup’s AOV climbed almost 13%, buoyed by an increase in order frequency and significant contributions from mass-market channels.

Ship-to-Home services recorded $1.5 billion in sales, up 6% from the previous year. This growth was fueled by a slight increase in the customer base and higher AOVs. Although the Ship-to-Home MAU base grew by about 3%, the volume of orders declined by 5% as MAUs placed fewer orders in October than in the previous year. Amazon’s pure-play segments led the way, contributing nearly 16% to YOY AOV growth.

The eGrocery MAU base expanded by 1.6% YOY, with 54% of U.S. households placing at least one online grocery order in October. Interestingly, the total household pool that has ever shopped for groceries online grew by only 0.6%, reaching nearly 79% of U.S. households, suggesting that most MAU growth came from reactivating less frequent or lapsed users.

According to David Bishop, partner at Brick Meets Click, the growth in Delivery reflects a shift in promotional strategies beyond typical subscription or membership discounts.

“Delivery is riding its next growth curve, fueled not simply by subscriptions or membership offers, but by promotional pitches that incent the customer to commit for a year,”

In response to these trends, some retailers offered substantial discounts on annual memberships rather than free trials, with deals ranging from 20% off at Kroger to 80% at Instacart. Retailers like DoorDash and Uber introduced free trial memberships of four weeks, and Amazon extended its trial period to 90 days, coinciding with its recent Prime Day event.

While these discounts have accelerated Delivery growth, they also pose challenges for retailers without comparable offers. As stated in the report, cross-shopping rates increased in October, with 40% of households ordering from both grocery and mass-market formats.

This trend, alongside a widening gap in repeat purchase intent between Grocery and Mass services, suggests that retailers may need to adjust strategies to retain customers. The repeat intent gap for Pickup services, in particular, has grown significantly, posing additional competitive pressure.

Mark Fairhurst, Chief Growth Officer at Mercatus, pointed out opportunities for regional grocers to bolster customer loyalty in the face of increased competition. “As national giants like Walmart accelerate growth with aggressive membership offers, there are effective ways for regional grocers to adapt and better connect with their core customers,” Fairhurst stated. He emphasized that enhanced loyalty programs and targeted, personalized campaigns could help regional grocers strengthen their market position.

The Brick Meets Click/Mercatus Grocery Shopper Survey, which polled 1,847 adults in October 2024, has tracked these dynamics, adjusting for non-response biases to reflect a representative sample of U.S. grocery shoppers.

The survey’s findings underline the evolving landscape of the eGrocery sector and provide insights into consumer trends and the impact of digital transformation in grocery shopping. For more details on October’s results, readers can refer to the latest eGrocery Dashboard or explore the comprehensive monthly report.