Mexico’s organic agriculture sector continues to grow significantly, despite a decrease in the number of certified organic producers.

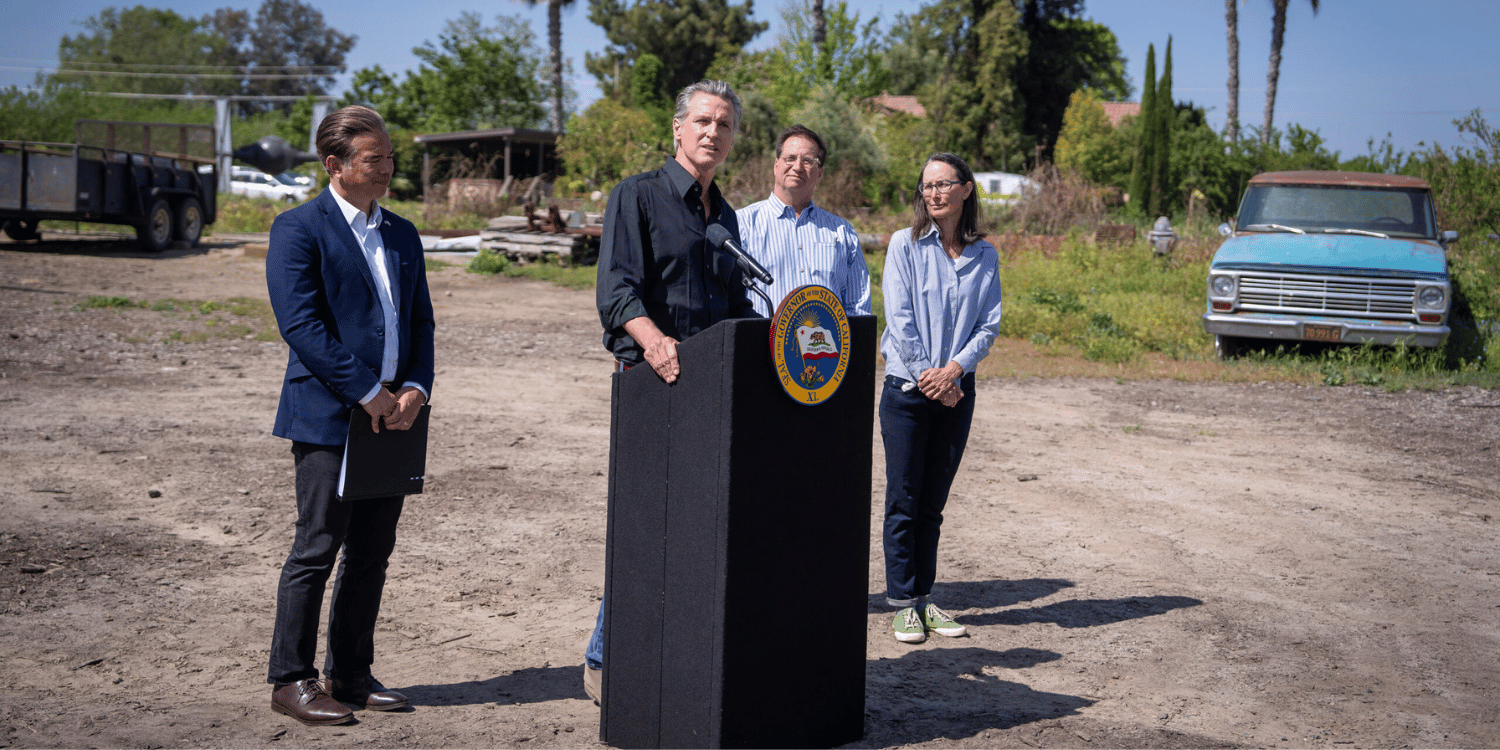

The latest GAIN report: Mexican Organic Production and Trade, prepared by Adriana Otero Arnaiz and approved by Alexander Chinh, highlights an expansion in organic production area, particularly for key fruit crops, reflecting the dynamic nature of organic trade between the United States and Mexico.

The organic trade between the U.S. and Mexico reached unprecedented levels in 2023.

U.S. organic exports to Mexico hit a record $234 million, while organic imports from Mexico surged to $1.4 billion.

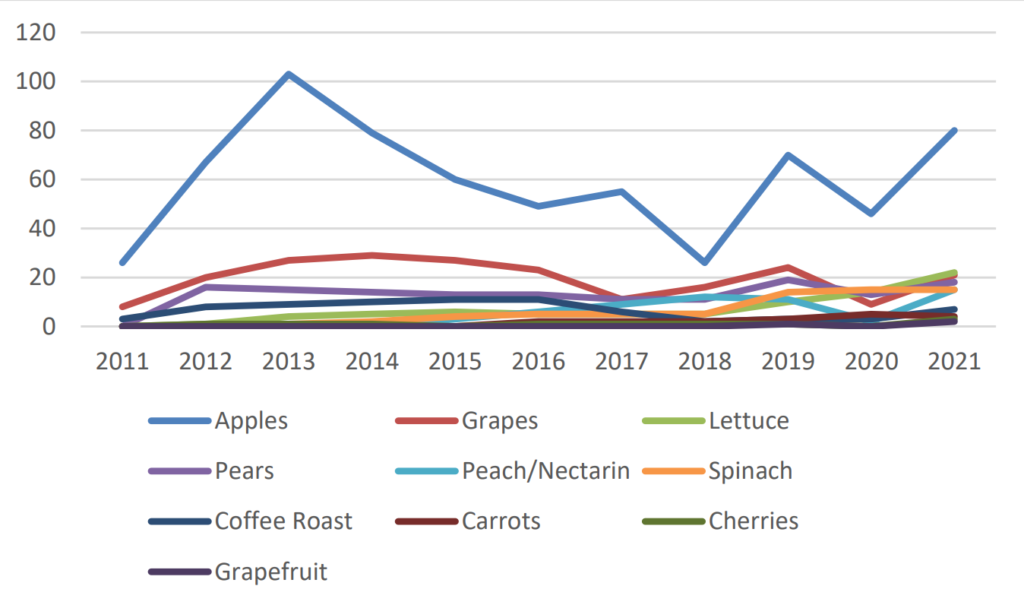

The primary organic exports from the U.S. to Mexico included apples, pears, grapes, spinach, and lettuce.

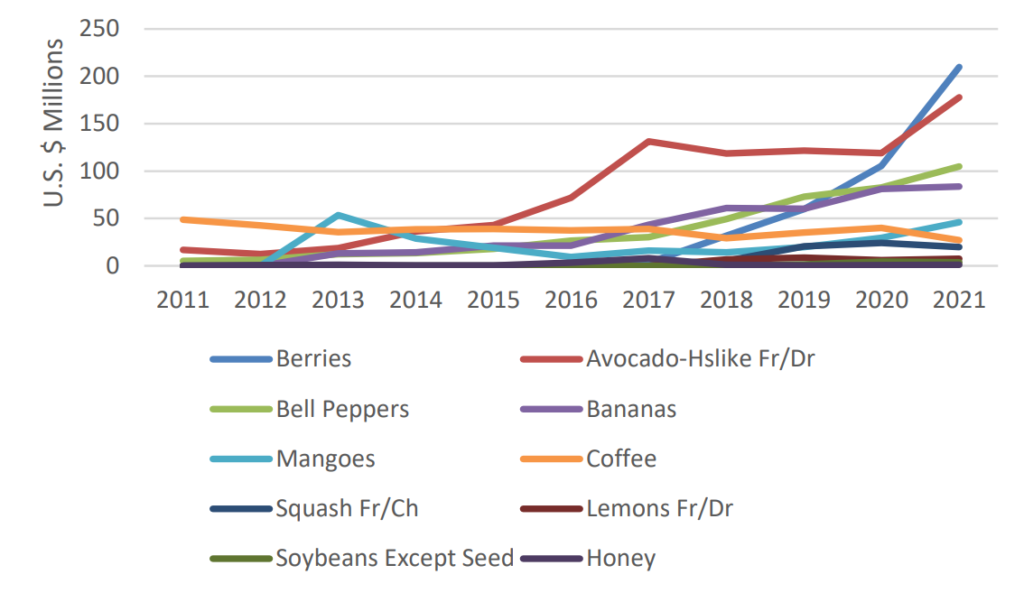

Conversely, Mexico’s top organic exports to the U.S. were avocados, strawberries, raspberries, blackberries, and tomatoes.

This thriving trade underscores the robust demand and efficient transportation channels between the two countries.

Contents

Expansion in Organic Production Area

In 2023, Mexico’s organic-certified area totaled 571,608 hectares, with 60% dedicated to harvesting or collection and 40% to crop production.

The increase in organic production area for specific fruits was particularly noteworthy.

Organic orange production area expanded from 16,668 hectares in 2022 to 20,943 hectares in 2023.

Similarly, mango and lemon production areas grew from 13,598 to 16,506 hectares and 5,068 to 6,266 hectares, respectively.

Decline in Certified Organic Producers

Despite the increase in production area, the number of certified organic producers saw a decline.

In 2023, there were 46,030 certified organic plant producers, a 4% decrease from the previous year.

Of these, 91% were coffee producers.

The organic beekeeping industry, comprising 99% of certified animal producers, also experienced a reduction, falling from 3,070 producers in 2022 to 3,022 in 2023.

The most significant decrease occurred in the processed products sector, which saw a 30% drop to 4,257 producers.

The Cornerstone of Mexican Organic Agriculture: Coffee

Coffee remains the cornerstone of Mexico’s organic agriculture, both in terms of area cultivated and the number of producers.

In 2023, there were 88,173 hectares of organic coffee planted, accounting for 40% of all organic production area.

The country had 41,911 organic coffee producers, mostly indigenous community organizations located in Chiapas, Oaxaca, and Puebla.

These organizations generate substantial income through direct export to specialty markets, primarily in the United States.

Notable organizations include UCIRI, CEPCO, ISMAM, Majomut, Yeni Navan, Tiemelonla Nich K Lum, Tosepan Titataniske, Tzeltal Tzotsil, and Maya Vinic.

Harvesting from Natural Habitats

Mexico’s organic production also includes the harvesting of natural resources from the wild.

In 2023, chicle, a natural gum used for chewing gum, was extracted from 256,000 hectares by three producers.

Other wild-harvested certified organic products include yuca, agave, prickly pear cactus, oregano, and xoconostle.

Additionally, 3,954 hectares were certified for hunting organic certification for quail, wild pig, dove, and deer.

Market Orientation & Challenges

The report highlights that the volume of organic production compared to conventional production remains low.

However, the premium price for organic products, particularly in export markets, makes organic farming more lucrative despite the higher costs associated with production and certification.

For instance, in Baja California, 95% of the strawberry area is organic and primarily directed to the U.S. market, fetching a price differential of 25%.

The Mexican organic market, though in its early stages, shows potential for growth.

Organic products are becoming more popular, supported by the current federal administration’s promotion of environmentally friendly practices.

Despite the high cost of organic products compared to conventional ones, there is a growing segment of the population with higher purchasing power that values sustainability, quality, and health benefits.

Policy & Certification

Mexico’s organic sector is regulated by the Secretary of Agriculture through SENASICA, with strict guidelines for certification and production.

As of January 1, 2022, all products marketed as organic in Mexico must comply with the Ley de Productos Orgánicos (LPO).

The U.S. products exported to Mexico must also meet Mexico’s organic labeling requirements and may display both the USDA organic seal and the Mexico organic seal if certified accordingly.

Opportunities & Challenges for U.S. Organic Exports

The rising Mexican household incomes post-pandemic and the “super peso” have made U.S. goods relatively more affordable for Mexican consumers.

Moreover, a significant portion of Mexican consumers considers sustainability and health benefits when making purchase decisions.

However, uncertainties related to the presidential elections in both Mexico and the U.S., changes in government policies, and global economic and environmental challenges could impact consumer confidence and spending levels.

Mexico’s organic agriculture sector is expanding, with significant growth in production area for key fruits and an increase in trade with the United States.

Despite a decline in the number of certified organic producers, the sector shows resilience and potential for future growth.

With continued support from the government and favorable market conditions, Mexico’s organic agriculture is poised to thrive, benefiting both domestic markets and international trade partners.