While overall food prices saw a slight increase in August, surges in eggs and meats offset declines in other grocery categories, reflecting mixed trends in household food expenses.

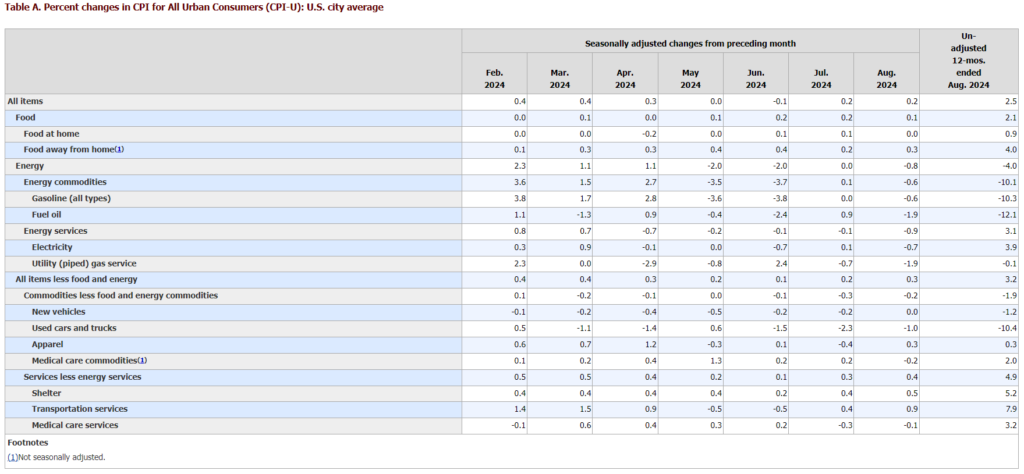

In August, the Consumer Price Index for All Urban Consumers (CPI-U) saw a 0.2 percent increase, matching the growth reported in July, according to the U.S. Bureau of Labor Statistics. Over the past year, the all-items index experienced a 2.5 percent rise, the smallest 12-month increase since February 2021.

Shelter costs were the primary driver of the monthly increase, rising by 0.5 percent in August. Other notable contributors to the CPI’s growth include a rise in the index for food away from home and a modest increase in prices for essentials such as motor vehicle insurance, airline fares, and apparel.

In terms of food prices, the food index saw a slight 0.1 percent uptick in August, after experiencing a 0.2 percent rise in July. Specifically, the food at home index remained unchanged, reflecting the mixed performance of grocery prices. Some grocery categories saw increases, while others decreased.

The index for meats, poultry, fish, and eggs, for instance, rose by 0.8 percent in August, largely driven by a notable 4.8 percent rise in egg prices. Dairy and related products also saw a 0.5 percent increase. However, the index for nonalcoholic beverages fell by 0.7 percent after previously rising in July, and declines were also observed in the indexes for other food at home, cereals and bakery products, and fruits and vegetables.

Over the past 12 months, the food index has risen 2.1 percent, with some specific categories seeing sharper increases. For instance, the meats, poultry, fish, and eggs index increased by 3.2 percent, while the nonalcoholic beverages index rose 1.3 percent.

In contrast, the indexes for cereals and bakery products, as well as fruits and vegetables, declined by 0.3 percent and 0.2 percent, respectively. As for food away from home, the index showed stronger growth, rising 4.0 percent over the year. Limited-service meals saw a 4.3 percent increase, while full-service meals rose by 3.8 percent.

Looking beyond food, other key indicators revealed varied trends. The index for all items excluding food and energy rose by 0.3 percent in August, following a 0.2 percent increase in July. This index, often used as a more stable measure of underlying inflation, has risen 3.2 percent over the last 12 months. Items such as household furnishings, communication services, and medical care showed price decreases, while education costs, motor vehicle insurance, and apparel registered increases.

Despite the modest overall rise in the CPI, the 2.5 percent increase over the past year reflects a period of relatively low inflation compared to recent years, when inflation was at its peak. The latest data offers a complex picture of price movements across various sectors, with some areas continuing to see price hikes, while others are experiencing declines. As stated in the report, the food away from home index is one area where prices remain on the rise, reflecting the broader trend of increasing costs in the dining sector.

These latest CPI figures provide an important snapshot of the current inflationary environment, highlighting how different sectors of the economy are responding to ongoing economic pressures. While some price categories have stabilized or even decreased, core expenses like shelter and dining continue to rise, contributing to the overall inflationary picture.