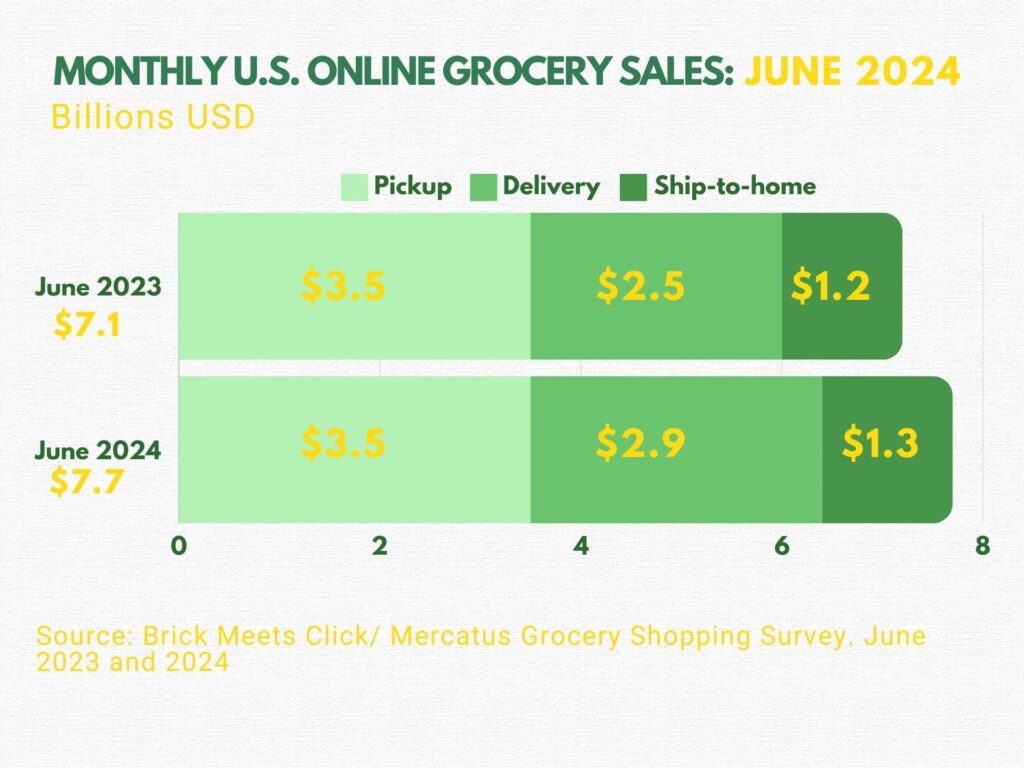

Delivery Sales Surge by 18% Amid Aggressive Promotions, While Pickup and Ship-to-Home Maintain Steady Growth

The U.S. online grocery market concluded June 2024 with impressive figures, recording $7.7 billion in monthly sales, marking an 8.0% increase compared to the same period last year.

This growth was significantly influenced by the performance of delivery sales, which experienced a notable surge following aggressive promotions.

The Brick Meets Click/Mercatus Grocery Shopper Survey, conducted on June 30, 2024, highlighted these trends.

Delivery sales reached $2.9 billion in June 2024, an 18% increase from the previous year. This growth was driven by an expansion in the monthly active user (MAU) base and increased order activity, despite a slight decline in the average order value (AOV).

The robust performance of delivery allowed it to capture 38% of the eGrocery market share for the month, gaining 325 basis points (bps) year-over-year.

David Bishop, a partner at Brick Meets Click, noted, “Delivery’s strong performance in June likely benefited from the promotional offers made last month, first by Instacart and then by Walmart.”

These promotions, which included significant discounts on annual membership fees, boosted both MAUs and order frequency for delivery services, particularly benefiting Walmart.

Meanwhile, Pickup sales remained stable at $3.5 billion, maintaining a consistent year-over-year performance. Although the MAU base for Pickup expanded moderately, the combination of a slightly lower AOV and decreased order frequency counterbalanced the positive impact of a larger user base.

Consequently, Pickup’s share of eGrocery sales declined by 352 bps, settling at 45% in June 2024, yet it continued to lead the market share.

Ship-to-Home sales also saw a rise, climbing nearly 10% from the previous year to $1.3 billion in June 2024. This marked the fourth consecutive month of year-over-year sales growth for Ship-to-Home, driven by higher AOVs despite a minor contraction in its MAU base and a dip in order frequency.

By the end of June 2024, Ship-to-Home accounted for nearly 17% of eGrocery sales, up 26 bps from the previous year.

The overall eGrocery MAU base expanded by almost 4% compared to June 2023, primarily due to the reactivation of lapsed users. The total number of households that have ever purchased groceries online grew by just 14 bps during the same period.

This discrepancy underscores that the increase in customers during June 2024 was largely fueled by less frequent users placing another order or lapsed customers giving the service another try.

According to the report, cross-shopping rates remained high in June 2024, with nearly one-third of customers buying online from both Grocery and Mass formats.

Specifically, 31.6% of Grocery customers, which include those shopping at Supermarkets and Hard Discounters, also received an online grocery order from a Mass retailer in June.

Additionally, 22% of Grocery customers received online orders from Walmart, representing a 150 bps increase from the previous year.

However, the repeat intent rate, which measures the likelihood of a customer completing another online order within the next 30 days, declined by nearly seven percentage points to 56.0% compared to the previous year.

This decline was most pronounced among the most frequent users—those who completed four or more orders in the past three months—who posted an almost ten-point drop from June 2023. Grocery’s repeat intent rate also fell more significantly than the Mass format’s rate.

The shifting dynamics in where households purchase most of their groceries also emerged, with the Mass format increasing its share by approximately 190 bps to 42% in June 2024, while the Supermarket format dropped by 250 bps to 39%.

This shift was primarily driven by an increase in households with annual incomes under $50,000 opting to shop at Mass retailers.

Mark Fairhurst, Chief Growth Officer at Mercatus, emphasized the need for regional grocers to regain market share by leveling the playing field against mass merchants. “Integrating personalized and targeted promotions into their first-party platform experience will be key to re-engaging lapsed customers and improving repeat purchase rates,” he stated.

Fairhurst also highlighted the importance of incorporating high-level, in-store customer service into the digital experience, leveraging a strength that regional grocers are known for, to gain an advantage over their mass competitors.

These insights provide a comprehensive overview of the current trends and challenges in the U.S. online grocery market, offering valuable guidance for industry stakeholders.